*This post is in partnership with TurboTax.

“We’re doing taxes today” was always a big day in my house growing up.

My parents would lug their typewriter sized calculator to the basement, their green visors, and a couple of flavored waters and we weren’t to disturb them for HOURS! Sometimes days even. I didn’t know what “we’re doing our taxes,” meant, but I could tell by their glum expressions it wasn’t a good thing. And thus I grew up dreading the day I would be an adult and figure out what said taxes meant.

But then something magical called “the internet” was born and things got a whole lot easier.

Take me for example, as a business owner and blogger, I have tax documents coming in from everywhere (about 25 and counting) and that’s far more than my parents ever had. And yet you’ll never find me sitting in a dark basement for days struggling to do my taxes while wearing a green visor.

TurboTax Self-Employed has basically grown with me over the years, from when I started out with just one return to file roughly 5-6 years ago when I was employed by another company, to today when I have several since I am self employed.

I have been blogging for about nine years but didn’t actually start monetizing my blog up until about five years ago. After finding myself stuck in a job that I hated, I decided it was time to give full-time blogging a shot; it was either now or never.

I started small and used the resources I had, working with just a few advertisers while also doing freelance writing jobs. Eventually, my audience grew and I realized that my goals had shifted more toward growing my t-shirt business – a business I never would have been able to start without this blog.

I’ve always wanted to work for myself, but there were certain aspects of it that intimidated me. Like for instance working with numbers (not my strong suit) or the overall technical side of being a small business owner. I’m more into the creative/design/marking aspects and am thankful there are sites like TurboTax Self-Employed that are able to hold my hand when it comes to doing the stuff I’m simply not good at- like taxes. TurboTax Self-Employed makes doing taxes as a small business owner easier than it has ever been before.

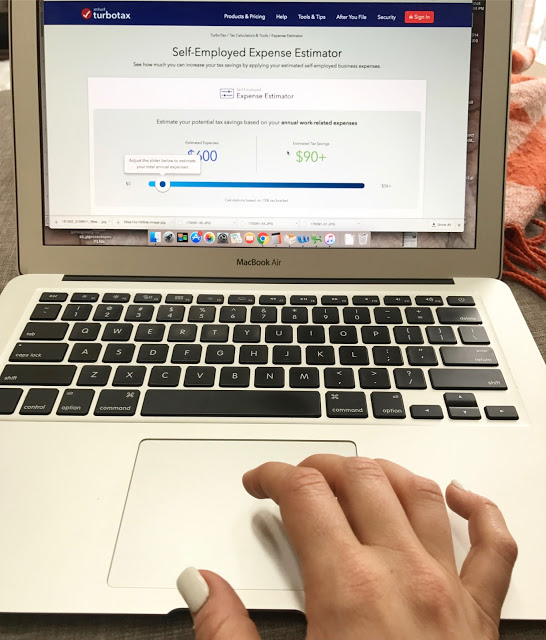

TurboTax’s Self-Employed Expense Finder helps small business owners find deductible business expenses they may not realize they can claim!

I ask a lot of questions and their live on-screen help is a life-saver. I also love their online guidance and self-employed expense estimator calculator, which allows you to see how much you can increase your tax savings by applying your estimated self-employed business expenses.

They also provide you with Smartlook and Quick Books Self Employed software, which anyone who owns a small business realizes is a huge perk! It helps me to track my expense year round and also in real-time! It’s also great for tracking miles and quickly capturing receipts.

Ugh, I hate doing taxes whether I'm a small or big business owner, or whether I'm self-employed or employed by someone else. It's the worst.

Charmaine Ng | Architecture & Lifestyle Blog

http://charmainenyw.com

this post is awesome but also reminds me that it is tax time. gulp.

Totally off topic of taxes but can you PLEASE tell me what nail polish you wear? I love that colour!